Four term sheet provisions that protect VC interests

Venture investing is risky. That’s why VCs are experts at building downside protections into their deals to limit their chances of losing money if an investment declines in value. It’s important to understand these protections, how they are structured and what they mean. Below, we break down four term sheet provisions that VCs utilize, providing examples, as well as specific deal data from the PitchBook Platform.

1. Voting Rights

Preferred stock oftentimes comes with Board seats and voting rights. With this, venture investors have more influence on the company’s operations, management and direction.

2. Dividends

Dividends are one of the rights that make preferred stock “preferred” rather than common. Dividends increase the total return to the preferred stockholders, and conversely decrease the total return to common stockholders. Dividends are often stated as a percentage of the original issue price for the preferred stock.

Cumulative Dividends

Investors push for cumulative dividends as a protective device to provide a minimum annual rate of return on their investment (say, 7% to 10%). It is typically tied-into the liquidation preference, thus giving the holders of preferred stock the right to receive their entire investment, plus any accrued dividends, when a company is sold or liquidated.

For example: Imagine a VC that bought 1,000,000 shares of preferred stock at an issue price of $10 per share. If these shares carried an annual 10% cumulative dividend and were held for five years then the VC’s return would be 1.5x their original investment upon exit. The VC now gets their original investment ($10 million) plus any unpaid dividends ($10 million x .10 = $1 million per year x 5 years = $5 million), thus giving the investor a total return of $15 million.

Non-cumulative Dividends

This is in contrast to non-cumulative dividends, which are paid on the preferred stock only if the Board of Directors declares them; if the Board of Directors doesn’t declare a dividend during a particular fiscal year, the right to receive the dividend extinguishes and doesn’t accrue from year to year.

Let’s highlight a specific deal from the PitchBook Platform that includes cumulative dividends as a provision. Below is the stock info for RiseSmart’s $11 million Series B financing in 2014, which was led by Accel-KKR and joined by Norwest Venture Partners. These investors received an annual rate of return of 14% on their investments, which was paid out after RiseSmart was acquired by Randstad for $100 million in September.

3. Liquidation Preferences and Participation

Liquidation preferences help ensure that the investor gets paid before there is a liquidity event (such as when a company is sold, goes public or declares bankruptcy). These preferences are especially important in the event that the company is liquidated for less than the amount invested in it.

Generally, venture investors are entitled to the amount of money they originally invested in the company—a 1x liquidation preference. Sometimes investors will ask for higher liquidation preferences, but this is not common practice because it reduces the potential value of equity—something that is used to attract qualified employees, especially those on the management team.

Rather than higher liquidation preferences, investors will ask for participating preferred. In this instance, the VC investors, as the preferred stockholders, are entitled to the return of their entire investment plus any accrued dividends, prior to the distribution of any proceeds to the common stockholders.

For example: A VC buys 50% of a company for $50 million, for a $100 million post-money valuation. If that company then sells for $75 million, the VC gets more than 50% of the $75 million. The VC gets his or her $50 million out first, and then half of the remaining $25 million ($12.5 million) for a total return of $62.5 million. The common stockholders split the remaining $12.5 million.

An intermediate approach to this is partial participating. In this instance, the investors don’t participate in the remaining assets of the company but they receive a guaranteed return that’s greater than 1x their investment.

For example: If a company were sold for $40 million, and the VC invested $5 million for one-third of the company, with a 2x participating preferred, the VC would receive $10 million off the top (not including any accrued dividends, if applicable), plus another $10 million (one-third of $30 million), for a total of $20 million. The VC would thus receive 50% of the sale proceeds even though it only owned one-third of the company.

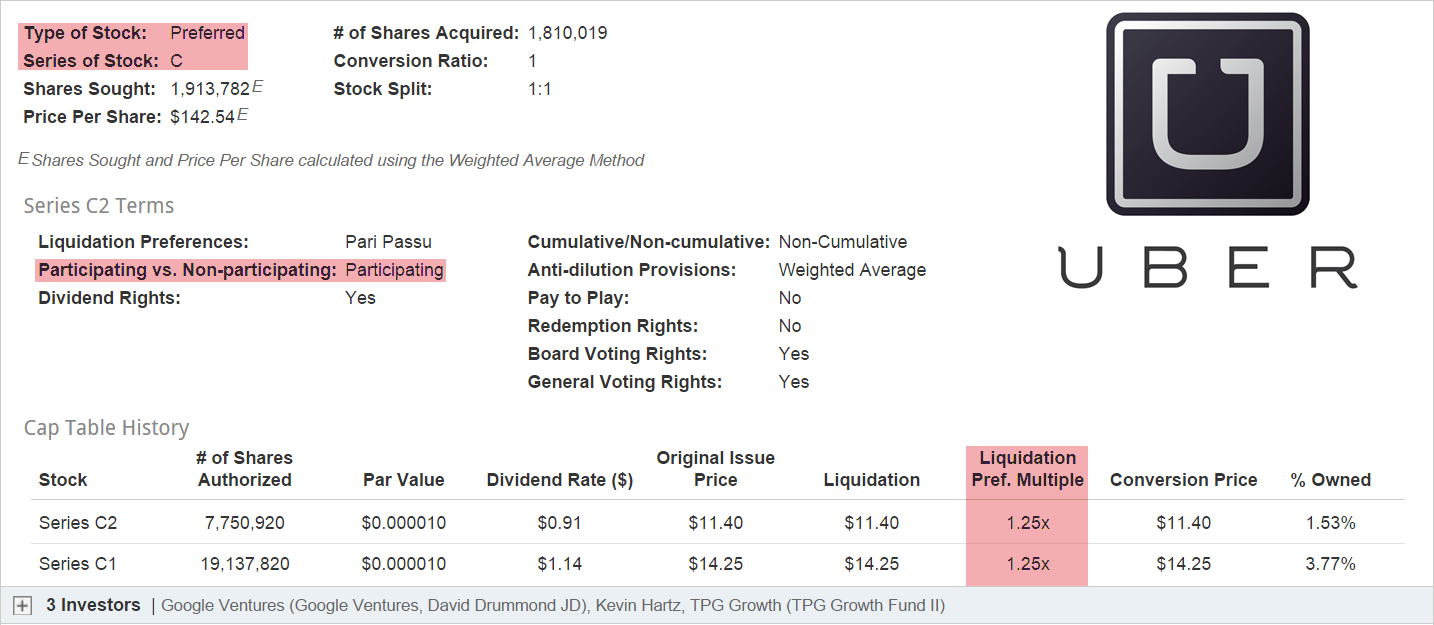

Below are the terms of Uber’s Series C financing round, which included participation from Google Ventures and TPG Growth. You can see that the investors are set to receive a guaranteed return larger than 1x.

4. Anti-Dilution

The anti-dilution provision protects investors in the event of a down round—meaning a company issues equity at a lower valuation than in previous rounds. There are two types of this provision: weighted average and ratchet-based.

Weighted Average takes into account both the lower price and the actual number of shares issued in the down round. The formula listed below is a typical calculation for a weighted average anti-dilution provision.

CP2 = CP1 x (A+B) / (A+C)

Where:

CP2 = Conversion price immediately after new issue

CP1 = Conversion price immediately before new issue

A = Number of shares of common stock deemed outstanding immediately before new issue [2]

B = Total consideration received by company with respect to new issue divided by CP1

C = Number of new shares of stock issued

For example: Suppose a company has 1,000,000 common shares outstanding and then issues 1,000,000 shares of preferred stock in a Series A offering at a purchase price of $1.00 per share. The Series A stock is initially convertible into common stock at a 1:1 ratio for a conversion price of $1.00.

Next, the company issues a Series B offering for an additional 1,000,000 new shares of stock at $0.50 per share. The new conversion price for the Series A shares will be calculated as follows:

CP2 = $1.00 x (2,000,000 + $500,000) / (2,000,000 + 1,000,000) = $0.8333.

This means that each of the Series A investor’s shares now convert into 1.2 shares of common stock (Series A original issue price/conversion ratio = $1.0 /$0.8333 = 1.2).

Full Ratchet works by simply reducing the conversion price of the existing preferred to the price at which new shares are issued in a later round.

If the preferred investor bought in at $1.00 per share, and later a down round occurs in which stock is issued at $0.50 per share, that same investor’s shares will now convert at $0.50 each. In this example, you can see that the preferred shares became convertible into two common shares post-issuance, where under weighted average the preferred shares became convertible into 1.2 shares.

Most term sheet protections come at the expense of common shareholders, which include founders and employees, so it’s important that the protections are reasonable and fair. If a VC is protected too much, it can hinder the growth and success of the company by hurting its chances to attract talent and gain additional investors down the road.

Original Source: http://pitchbook.com/news/articles/four-term-sheet-provisions-that-protect-vc-interests